A Bank Is Asset Sensitive if Its

None of the options is correct. This is known as liability sensitivity when funding costs increase faster than asset yields The biggest risk could come.

Asset Liability Management Determining Measuring Interest Rates Ppt Download

This bank also has 800 in total liabilities 400 of which will be repriced within the next 90 days.

. If a banks interest-sensitive assets and liabilities are equal than its interest revenues from assets and funding costs from liabilities will change at the same rate. Over the past several years banks have increased their reliance on wholesale noncore funding sources such as overnight funds certificates of deposit greater than 100000 brokered deposits and Federal Home Loan. None of the above.

Deposits and borrowings are affected by changes in interest rates. If a bank has a positive gap that is if it is asset sensitive the bank can hedge its interest-rate risk by which of the following activities. A negative gap or a ratio less than one occurs when a banks interest rate sensitive liabilities exceed its interest rate sensitive assets.

The exposure of NII to changes in interest rates can be measured by the dollar maturity gap DMG which is the difference between the dollar amount of assets that reprice and the dollar amount of liabilities that. B Interest-sensitive assets exceed its interest-sensitive liabilities. Rate-Sensitive Assets Liabilities.

An institution is said to be asset-sensitive if it has a positive dollar IS GAP while it is liability-sensitive if it has a negative dollar IS GAP. Interest-sensitive assets exceed its interest-sensitive liabilities. B Reduce maturities of its liabilities.

Currently the bank is earning 8 on its assets and is paying 5 on its liabilities. Interest-sensitive liabilities exceed its interest-sensitive assets. If a bank is asset-sensitive that means more of its interest-earning assets such as loans will reprice when rates change than its interest-bearing.

An entity is asset sensitive when the impact of the change in its assets is larger than the impact of the change in its liabilities after a change in prevailing interest rates. D Deposits and borrowings are affected by changes in interest rates. If a bank s interest - sensitive assets and liabilities are equal than its interest revenues from assets and funding costs from liabilities will change at the same rate.

C Interest-sensitive liabilities exceed its interest-sensitive assets. Because banks deal in loans or savings that may have adjustable rates that are dependent on the prime rate or. Increased exposure to short-term rate-sensitive wholesale funding sources can render a bank more liability sensitive increasing its exposure to rising rates.

A bank is asset sensitive if its. Advises banks on asset liability management. What is the dollar interest - sensitive gap of this bank.

A bank is asset sensitive if its. If a bank s interest - sensitive assets and liabilities are equal than its interest revenues from assets and funding costs from liabilities will change at the same rate. 127A bank is liability sensitive if its.

Banks with a positive cumulative interest-sensitive gap will benefit if interest rates rise but lose income if. C Interest-sensitive liabilities exceed its interest-sensitive assets. A bank is asset-sensitive if its.

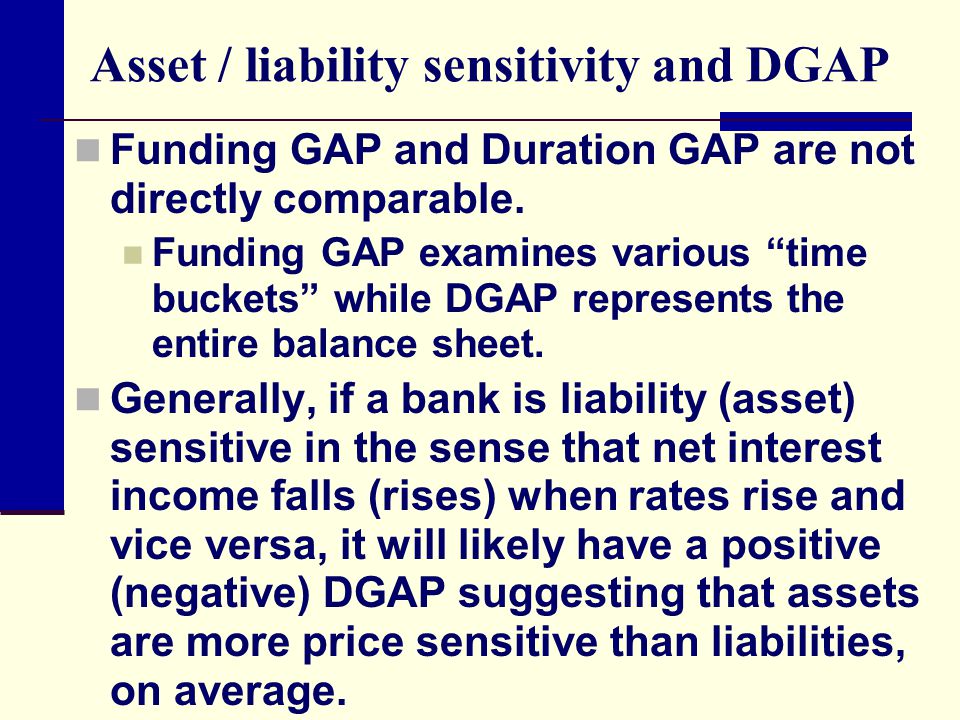

Asset sensitivity refers to a balance sheet structure where there is an asset liability mismatch and the assets re-price or reset faster than liabilities. C Use a long hedge. Further the bank is asset-sensitive if its liabilities reprice more slowly than its assets in a changing interest-rate environment.

A Loans and securities are affected by changes in interest rates. Loans and securities are affected by changes in interest rates. A bank is asset-sensitive if its.

A Loans and securities are affected by changes in interest rates. This means that interest rates on liabilities are locked down for longer periods of time when compared to assets. E None of the above.

The change in a banks net income that occurs due to changes in interest rates equals the overall change in market interest rates in percentage points times ____________. Banks with a positive cumulative interest - sensitive gap will benefit if interest rates rise. As one of the largest commercial lenders Bank of America is very asset-sensitive meaning that when rates rise the yields on more of its.

Prime banks interest-sensitive assets have a value of 300 and its interest-sensitive liabilities are worth 250. Calculate the dollar IS GAP. Interest-sensitive assets exceed its interest-sensitive liabilities.

This occurs when either the timing or the amount of the rate changes for liabilities causes interest expense to change by more than the change in interest income. Interest-sensitive assets exceed its interest-sensitive liabilities. Interest-sensitive liabilities exceed its interest-sensitive assets.

E A and C only. B Interest-sensitive assets exceed its interest-sensitive liabilities. D All of the above.

A Reduce its asset maturities. Deposits and borrowings are affected by changes in interest rates. A Deposits and nondeposit borrowings are affected by changes in interest rates B Interest-sensitive assets exceed interest-sensitive liabilities C Interest-sensitive liabilities exceed its interest-sensitive assets D Loans and securities are affected by changes in interest rates E None of the above Answer.

Loans and securities are affected by changes in interest rates. Banks with a positive cumulative interest - sensitive gap will benefit if interest rates rise. 82A bank is asset sensitive if its.

Many community banks that manage as if they are asset sensitive will actually experience earnings pressures when interest rates rise he says.

Asset Liability Management Tools Financetrainingcourse Com

Managing Interest Rate Risk Duration Gap And Market Value Of Equity Ppt Video Online Download

Comments

Post a Comment